About Us

Vanguard 1031 Exchange - Safeguard Your Investments

We are a national, fully independent, 1031 Exchange Qualified Intermediary

We work for you, not against you

At Vanguard 1031 Exchange, our focus is on being consultative and solutions oriented. Uniquely, we are one of the only fully independent, national, 1031 Exchange Facilitators, that employ experts who have achieved the designation ‘Certified Exchange Specialist’

Vanguard 1031 Exchange has been a leading choice of attorneys, real estate professionals, and family offices when experience, certainty, and speed of execution are paramount.

Our Team

Brandon Burns

President of Vanguard 1031 Exchange

With Vanguard 1031 Exchange,

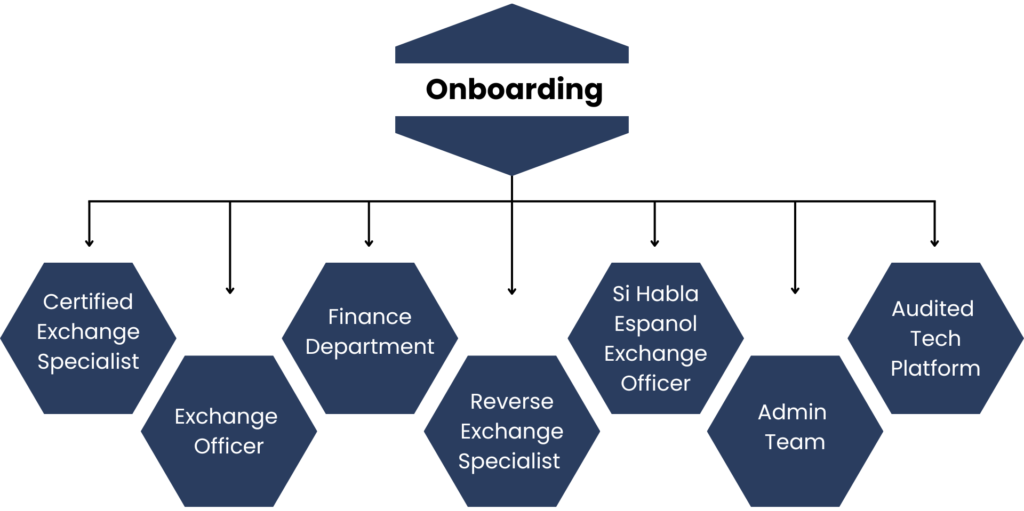

GET A TEAM OF EXPERTS

supporting you throughout your exchange process

California

Texas

Florida

Our Difference

Provides segregated and insured exchange accounts

Providing detailed reporting

Provides a Fidelity Bond specifically designed for Qualified Intermediaries

Requires signed client authorization to transfer funds

Deposits all exchange escrow funds in an FDIC insured bank, offering up to $100,000,000 of FDIC insurance per exchange.

Employs people who have achieved the Certified Exchange Specialist designation.

Successfully completed a System and Organization (SOC) 2 Type 1 audit.

Us

Them

Flat Fee

No Hidden Charges

No Document Preparation Charges

Them

No Flat Fee

Hidden Charges

Document Preparation Charges

If you or your client owns investment property and are thinking about selling it and buying another property, you should consider 1031 tax-deferred exchange.

For 1031 exchange assistance, please call one of our following offices:

San Diego, CA – 858-331-1031

Dallas, TX – 469-620-8588

Toll Free (USA) – 855-489-1031

Trust & Experience

While following the IRS requirements of strict adherence to regulatory compliance, we uniquely pair this with a focus on being consultative and solutions oriented.

Our Podcasts

It’s a strategic business decision

Selecting the right qualified intermediary for your 1031 exchange is not just a critical step in meeting the requirements set by the Internal Revenue Code; it’s a strategic business decision that can affect the outcome of your investment.